COVID-19 at its peak caused the steepest demand drop in oil history, albeit with stark differences across fuel types and sectors of economic activity. Is demand set to rebound with a vengeance once the global economy recovers from the pandemic, or will new ways of life and work learned in confinement stick and durably alter oil consumption patterns?

Demand has already begun to bounce back, but the rebound is unequal across products and regions

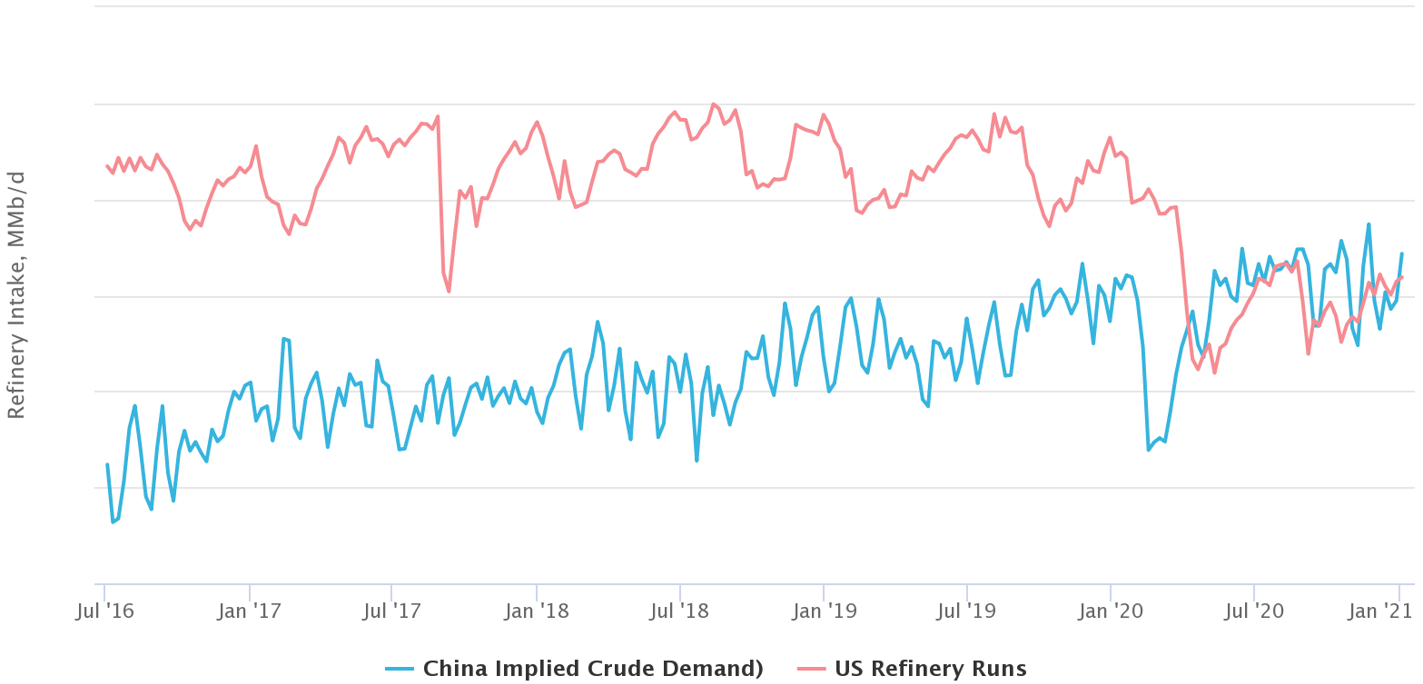

Demand is clearly off its lows, but with vast differences across regions, use types and sectors of economic activity. At the refinery level, COVID-19 has accelerated an eastbound shift of refining capacity and refinery run rates that was long underway. Crude oil demand is moving east to Asia. Within Asia, China’s share of demand is racing ahead of its neighbors. End-user demand is also on the mend, but here too the recovery is faster in developing economies than in OECD countries. Demand trends also show considerable divergence across market segments, with products like diesel and petrochemical feedstocks exhibiting resilience during the lockdowns and growth afterwards, and others less so.

The faster pace of recovery of refinery operations in China than in the US has led to convergence in crude demand between these two economies. The trend had long been underway. Prior to the pandemic, however, Chinese and US refinery runs remained more than 2 mb/d apart. COVID-19 has closed the gap, and China is now on the verge of surpassing the US as the world’s largest refining center.

Kayrros calculates Chinese crude demand (implied refinery runs) as the difference between crude supply and measured inventory changes, providing a fuller and timelier picture than official statistics. These measurements show that Chinese refinery runs have not only returned to pre-COVID levels but surged to new highs in the summer, only to retreat somewhat more recently. In contrast, US refinery runs, as reported by US EIA, remain significantly below their pre-COVID levels, despite some recovery from their April-May trough.

COVID-19 has thus helped China overtake the US as the world’s largest refiner

China’s preeminence as a refining power may undergo temporary setbacks. Chinese demand faced renewed headwinds with new restrictions on domestic travel ahead of the Chinese New Year, normally a high-demand season. Yet growth in Chinese refinery demand is a secular trend that has yet to run its course. In the US, currently low refinery activity is set to rebound when the COVID-19 recedes in the rearview mirror. But the negative demand shock of the pandemic has accelerated the retirement of some of the country’s older, smaller or less competitive refinery units or their conversion into renewable fuel facilities. New restrictions in drilling permits on federal land announced by the Biden administration could also over time chip at the cost advantage of US refiners, thus dampening US merchant refining activity. Chinese runs may yet fall back below those of the US again, but the secular shift in refining activity from the US to China looks here to stay.

This is a sanitized excerpt of a larger report sent to Kayrros subscribers.