Jet Fuel Intelligence enables traders, asset managers and hedge funds to get accurate near-realtime jet fuel consumption data with high granularity at region, country or airport level.

Using aircraft transponder data, Kayrros assesses flight distance and time flown, which, when coupled to aircraft performance, delivers an accurate view of fuel consumed.

Use identified trends to improve supply and demand balances and develop refined product trading strategies.

///

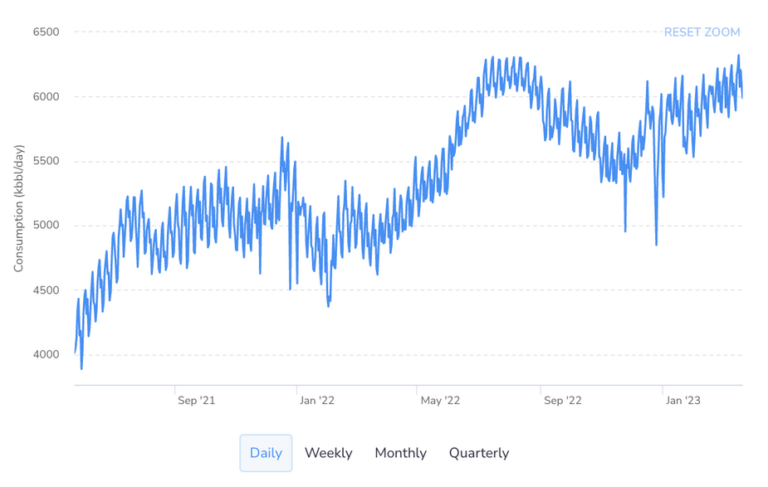

Accurate market forecasts measurement

Kayrros prior-month forecasts of jet fuel consumption in the US deliver accuracy of 95% compared to monthly EIA product supplied reports.

Historical

data analysis

The Jet Fuel Demand product dataset starts in 2019.

///

Geographical breakdowns

Kayrros data on jet fuel demand are available at multiple levels of granularity from airport to region to operator.

Daily updates

Kayrros Jet Fuel data is updated every day to give you access to the latest trends on product demand.

///

Dashboards

Kayrros provides a complete dashboard on Jet fuel demand, updated daily.

Rest API

Kayrros provides access to its data via REST or Python APIs

Weekly Reports

Kayrros sends regular analysis on industrial activity in weekly Kayrros Eye customer newsletter.

///

Crude Oil

Intelligence

Optimize trading decisions with comprehensive, granular near-realtime crude oil inventory measurements

LNG

Intelligence

Carbon

Watch

Make the best allowance trades with detailed and timely information on physical demand for EU and UK carbon credits

E&P

Intelligence

Improve capital allocation and boost portfolio returns with unique insights on US oilfield operations

///

Kayrros rises to #30 in Fortune’s ‘Change the World’ 2024 list

The Global Methane Pledge, Three Years On: Partial Progress Report

Kayrros Carbon Watch introduces EU carbon emissions forecasts