- Texas is once again feeling the heat of rapidly warming temperatures. Will recent increases in its power generation capacity be sufficient to avert the kind of power outages and skyrocketing energy bills that plagued residents last year?

- After sizzling temperatures and record-high power prices in summer 2022, this summer is off to an even earlier start, with record electricity demand and a heat index up to 120°F.

- Based on reports from electricity producers, ERCOT, the state regulator, projects that capacity will generally be sufficient to meet summer demand. As the grid is pushed to its limits, growth in renewable energy capacity achieved in the last 12 months is a key reason the state has managed to evade rolling blackouts thus far – and more capacity is due to come online in the coming weeks.

- But public sources are a blunt instrument to assess the timeline of new renewable capacity and its effect on future power supply/demand balances. Thus, ERCOT projections suggest an extra 3.4 GW of utility-scale solar generation capacity is due to be completed by end-August – but according to Kayrros forecasts, this may be somewhat misleading for at least two opposite reasons: on the one hand, some large projects appear to be late and will not come online until after the summer. On the other hand, other projects are early and partially online, but will only be accounted for as such in ERCOT statistics when their full projected capacity is operational. This means that the balance still due to come online may be far less than it appears.

- This kind of wedge between projections and reality is a harbinger of things to come. Heatwaves and extreme weather are the new normal, not the exception. Amid erratic weather patterns and fast but bumpy renewable capacity growth, unpredictability has become the name of the game in electricity and associated natural gas markets.

- Renewable generation, especially coupled with utility-scale battery storage systems, is clearly the tool of choice for meeting increasing and volatile demand. With public sources only providing an imperfect outlook on renewable capacity growth, the transparency derived from satellites and geolocation data is increasingly needed to stay ahead of the next crisis.

Renewables in the balance

As weather patterns become more extreme and peak demand exceeds on-demand dispatchable power capacity, electricity markets increasingly depend on renewable energy and battery storage to balance demand.

- Texas, where solar power has been fast growing, is a case in point. Extreme weather, including winter freezes and summer heat waves, has wreaked havoc in the state’s electricity market lately. This summer is already setting new records for temperatures and peak electricity requirements.

- ERCOT, the state regulator, projects summer demand to peak this year at 82,739 MW, up from last year’s high of 80,000 MW. That’s above what Texas can generate from on-demand dispatchable power, according to ERCOT’s latest Seasonal Assessment of Resource Adequacy (SARA) report.

- That leaves renewable energy to fill the gap. But will it be up to the task? It depends.

WIll new solar capacity win the race against demand?

New solar power that came online in the last 12 months has already been a big help so far this summer, mitigating vulnerabilities in dispatchable resources and helping tame wholesale energy prices.

- The state’s utility-scale solar capacity (consisting of projects of 50 MW or more) has grown by 2.9 GW (28.2%) in the last 12 months, following growth of 5 GW a year earlier, as reported by ERCOT. Project completions slowed in H2 2022 due to supply-chain bottlenecks, but regained momentum in H1 2023. These recent additions appear to be making a big difference, compared to an especially challenging summer 2022.

- But with summer off to an early start this year and temperatures already up to new highs, stability of the state’s grid will likely depend on whether further incremental solar capacity comes online as planned in the next few weeks.

Short-term solar capacity expansion may disappoint

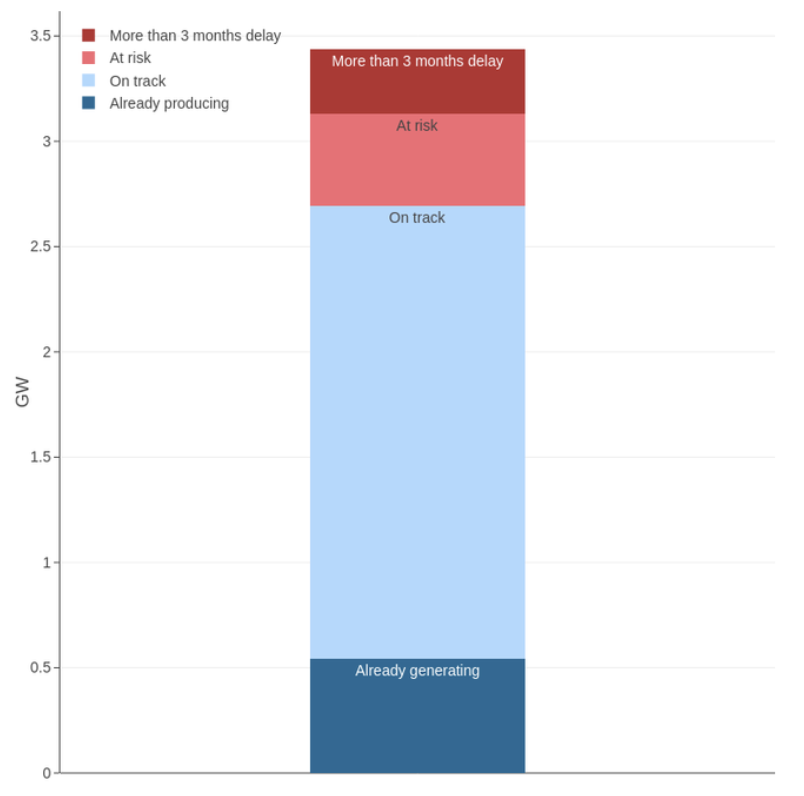

According to Texas state regulator ERCOT, based on statements from electricity producers and project developers, 3.4 GW of incremental utility-scale solar capacity is due to be completed by end-August. On paper, this will go a long way to balance demand.

- According to Kayrros forecasts, however, this projection ought not to be taken at face value – for at least two opposite reasons.

- First, some of that incremental capacity is early and already online, thanks to the early start of operations at certain assets, but will only be accounted for as such in ERCOT data when the projects’ full capacity is operational. Thus, the balance that has yet to come online is less than it might appear.

- Second, some of that capacity is late. At least two major projects are suffering significant delays and will not likely come online until after the summer demand peak.

- Of the 3.4 GW of incremental solar capacity planned for this summer, Kayrros Renewable Energy Monitor thus reckons that at most 2.2 GW of capacity will eventually be added to the grid.

Some projects are (partly) early...

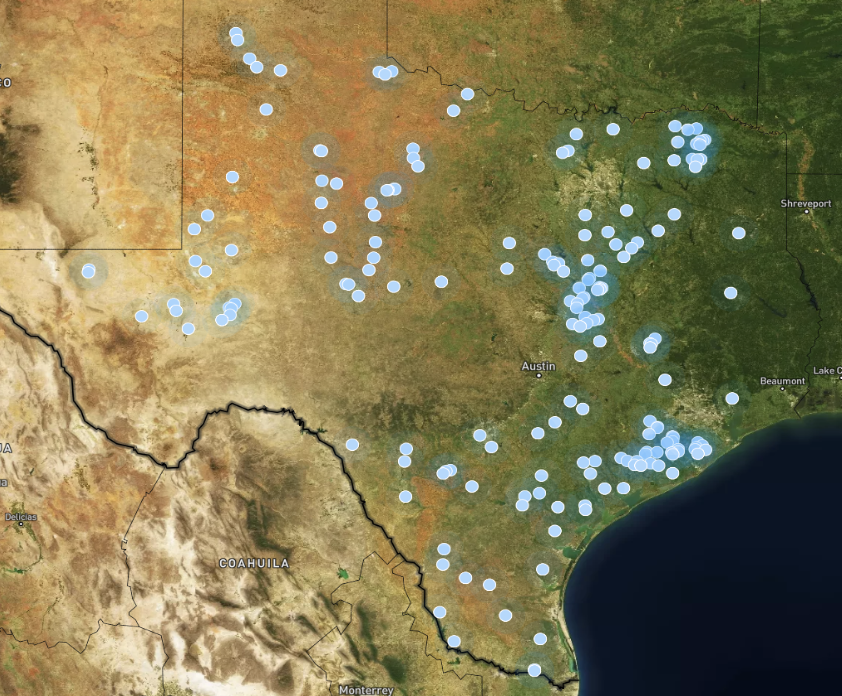

Thanks to its tracking of over 250 utility-scale solar projects in near realtime, Kayrros Renewable Energy Monitor reckons that at least 0.5 GW of the incremental 3.4 GW capacity projected by ERCOT for this summer is already synced to the grid.

|

...others are late

Source: Kayrros modified Sentinel-2 image

- Bright Arrow, a 305 MW plant with a COD for July 2023. It will likely be delayed well past this summer, as no panels have yet been installed.

- Buffalo Creek, a 439 MW plant which has seen construction slow down drastically since 2023, and which is not expected to be completed before October 2023.

In a turbulent world, transparency is key

While Texas electricity markets have mostly stabilized this year, thanks to easing natural gas prices and renewable capacity growth, supply/demand balances remain precarious. Recent heatwaves have seen price spikes and led ERCOT to issue a voluntary power conservation notice. Controlled outages may be needed if the grid is overloaded.

- Last May, Peter Lake, who later resigned as chairman of the Public Utility Commission of Texas after state lawmakers rejected his call for more on-demand power sources, cautioned that despite nominally sufficient capacity, the state’s grid could face adequacy challenges this summer.

- In short, how well Texas utilities will handle this summer’s heat is too close to call – hence the need to monitor capacity growth day to day.

- Heatwaves and extreme weather such as Texas has been experiencing are becoming the norm, not the exception. Amid erratic weather patterns and fast but bumpy renewable capacity growth, unpredictability has become the name of the game in electricity and gas markets.

- More than ever, the transparency derived from satellites and geolocation data is needed to stay ahead of the next crisis.