- A year after Russia’s invasion of Ukraine, satellite data show that far from plunging as initially feared, onshore crude oil stocks have built by an average 400,000 barrels per day since the onset of the war, or roughly 150 million barrels.

- While many commentators have been speaking of a war-induced global energy crisis, the data, as far the crude market is concerned, suggest otherwise, revealing instead surprising resilience in the face of unprecedented geopolitical shocks.

- The build, occurring against the backdrop of OPEC supply cuts and rising global oil demand, shows that while international sanctions may have rerouted oil trade flows, overall Russian crude export volumes have remained largely unscathed.

- China has played a key role in the rebalancing of the crude market in more ways than one. Not only has it emerged as the top outlet for Russian crude, but its own crude stocks have undergone large up and down swings since the onset of the invasion, much as they did in 2020-2021 during the first wave of the Covid-19 pandemic.

- Thanks to its massive crude storage infrastructure, China has emerged as de facto global swing supplier, with the capacity to absorb huge amounts of excess oil production at times of oversupply and draw down its stocks when markets tighten.

- While the roller coaster has been reminiscent of 2020-21, this time around different Chinese companies have been responsible for it, with state-owned Sinopec, rather than Shandong refiners, leading the charge. Sinopec got 44% of the refined product export quotas issued by Beijing last year, which may have given it an incentive to process more crude. Unlike independent refiners, state-owned enterprises are not subject to crude import quotas.

- Beijing recently raised crude import quotas, boosting its intake of Russian crude at a time when new EU and G7 sanctions on Russian refined products might force Russia to cut its own refinery runs and crude production.

A year after Russia's invasion of Ukraine, global crude stocks are on the rise

Figure: Global onshore crude oil inventories (daily)

Kayrros daily satellite monitoring of onshore crude tanks shows that global crude stocks, far from plunging on the back of reductions in Russian supply as many analysts had feared at the onset of the war, have built by an average 400,000 bpd since February 2, 2022, or roughly 150 million barrels.

- The gain has recently been accelerating, rising to 760,000 bpd so far in 2023. Against the backdrop of growing global oil demand and OPEC supply restraint, it shows that Russian crude exports have so far remained unimpeded by international sanctions,

China's storage roller-coaster heralds its rise as top swing player

Figure: China onshore crude oil inventories (daily)

In contrast with global stocks, Chinese crude inventories are little changed from pre-invasion levels, up just ~20 million bbls, or 60,000 bpd. But this follows a roller-coaster that saw successive steep builds and draws in 2022 and early 2023.

- China’s huge crude storage capacity allows it to play an outsize role in oil markets, absorbing vast amounts of excess crude supply or drawing down stocks when markets tighten.

- Chinese destocking helped global crude prices ease in 2H 2022 despite OPEC’s decision not to accommodate US demands for more production.

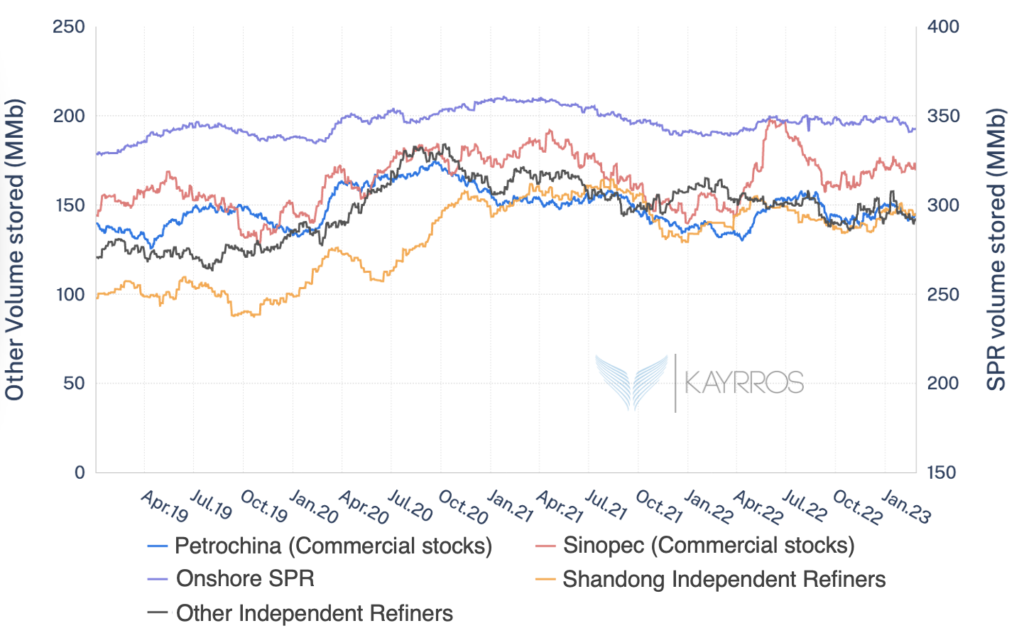

State-owned Sinopec crude stocks hit all-time high in 2022

Figure: China onshore crude oil inventories by main categories (daily)

China’s inventory swings of 2022 are reminiscent of the pattern of 2020-21, when its massive stock builds at the onset of the pandemic, combined with OPEC+ and US production cuts, played in key albeit somewhat under-appreciated role in rebalancing the ailing oil market.

- This time around, however, State-owned Sinopec, China’s largest refiner, rather than the independent refiners of Shandong province, led the build. Sinopec’s crude stocks last year vastly surpassed their earlier Covid highs, whereas the stock gains of Shandong refiners were more subdued. Sinopec also led the 2H 2022 drawdown.

- Sinopec’s dominance of the Chinese inventory response to the Ukraine war – and China’s zero-Covid policy – may reflect Beijing’s efforts to rein in private companies and reassert state control over the national economy. Unlike independent refiners, Sinopec is not subject to crude import quotas. It also received the lion’s share of refined product export quotas issued by Beijing last year.

- Beijing’s recent move to raise import quotas has already resulted in an increase in Russian crude imports to record highs, at a time when new sanctions on Russian product exports may force Russia to cut its own refinery runs and crude production.